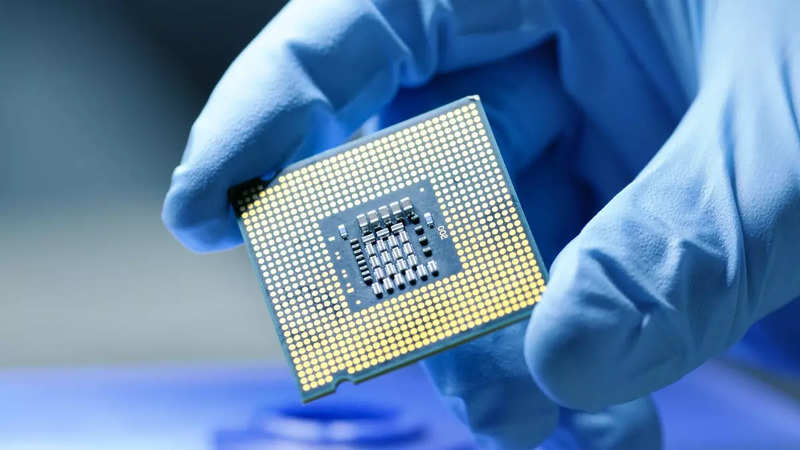

Chinese language chip foundry Semiconductor Manufacturing International Corp (SMIC) warned of a weak 2023 regardless of document excessive gross sales final 12 months, as slowing demand for electronics positioned strain on its enterprise.

Backed by funding from Beijing, SMIC is China’s finest hope for changing into a worldwide chief in chip manufacturing that may rival Taiwan Semiconductor Manufacturing Corporation (TSMC), the trade’s largest foundry.

SMIC has seen gross sales surge over the previous two years, as world demand for low-end chips rocketed within the wake of the COVID-19 pandemic and a worldwide chip scarcity.

On Thursday, it mentioned complete income for 2022 reached $7.23 billion, up 33.6% from 2021. That was under a mean estimate of $7.35 billion, based on a survey of analysts on Refinitiv, and on the low aspect the corporate’s late November forecast of “round $7.3 billion.”

The corporate’s development could also be peaking, nevertheless, with demand for client electronics waning because the pandemic subsided.

Learn Additionally

In its monetary submitting, SMIC mentioned it expects income for 2023 to “decline by low-teens proportion year-over-year,” which might mark a break from continuous development.

Web revenue final 12 months hit $1.82 billion, a 6% year-on-year improve, whereas gross sales within the last quarter of 2022 hit $1.62 billion, about 2% year-on-year and marginally under analyst expectations.

Gross revenue over the identical interval fell barely, hitting $518.7 million down from $552.8 million the 12 months prior.

The corporate stays generations behind rivals in modern know-how and has been in Washington’s crosshairs in recent times amid an ongoing spat with Beijing over chip know-how.

“In 2022, the market demand for smartphones, computer systems, and residential home equipment turned from robust to weak, and prospects’ willingness to position orders was considerably weakened,” mentioned SMIC co-CEO Zhao Haijun on an earnings name.

Learn Additionally

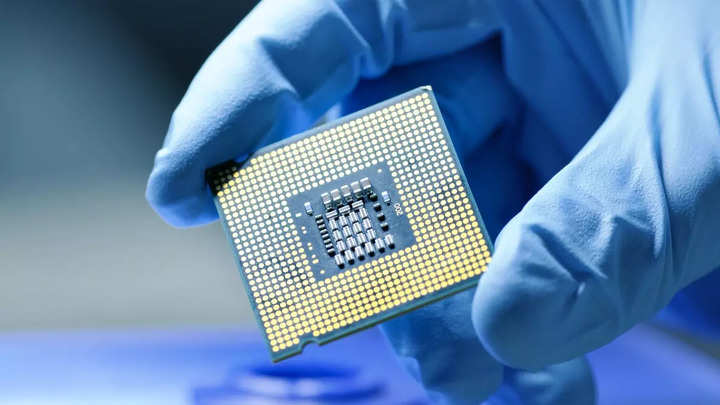

In early October, the US division of commerce launched a sweeping set of export controls aimed toward containing development amongst China’s chip producers.

The restrictions are additional set to hamper SMIC’s ambitions for making superior chips, consultants say.

Nonetheless, it’s quickly increasing capability throughout China, saying plans to construct 4 new chip manufacturing vegetation since 2020.

On its earnings name, co-CEO Zhao Haijun mentioned that by the top of 2022, its latest fab in Shenzhen had entered manufacturing, one other fab entered “pilot manufacturing,” and two others remained beneath building.

FbTwitterLinkedin