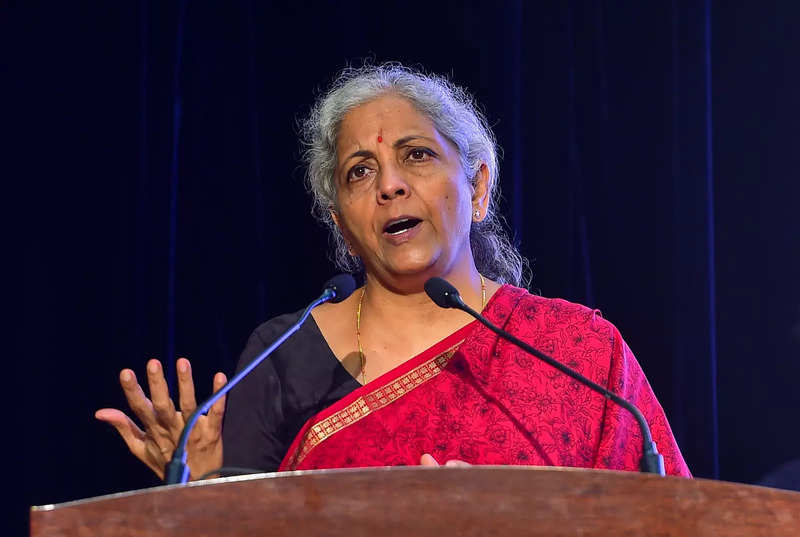

Union Finance Minister Nirmala Sitharaman

India is aiming at growing normal working procedures for cryptocurrency throughout its G20 presidency subsequent yr, Finance Minister Nirmala Sitharaman has stated, underlining that each one nations need the expertise to outlive however not be misutilised.

“That (crypto) may even be a part of India’s factor (agenda throughout G-20 presidency),” Sitharaman informed a gaggle of Indian reporters earlier than concluding her journey to Washington DC to attend the annual conferences of the International Monetary Fund and the World Bank.

India will assume the Presidency of the G20 for one yr from December 1, 2022 to November 30, 2023. Below its Presidency, India is predicted to host over 200 G20 conferences throughout the nation, starting December 2022.

Sitharaman has been making a robust case for international regulation of cryptocurrencies to sort out the dangers on cash laundering and terror funding.

Learn Additionally

Noting that establishments, that are related to the G-20 or the World Financial institution or any such organisation, are doing their very own evaluation and research of issues associated to cryptocurrencies or crypto belongings, the minister stated, “We’d undoubtedly need to collate all this and do a little bit of research after which convey it on to the desk of the G-20 in order that members can talk about it and hopefully arrive at a framework or SOP, in order that globally, nations can have a expertise pushed regulatory framework.”

The G20 is an intergovernmental discussion board comprising 19 nations and the European Union. It really works to handle main points associated to the worldwide economic system, reminiscent of worldwide monetary stability, local weather change mitigation, and sustainable improvement.

Sitharaman underlined that nobody single nation can successfully deal with or regulate crypto in any type.

“However implicit in that is that we do not need the expertise to be disturbed. We wish the expertise to outlive and likewise be ready for the FinTech and different sectors to learn from it.

“But when it’s a query of platforms, buying and selling on belongings which have been created, shopping for and promoting making income and extra importantly in all these are nations ready to grasp the cash commerce, are we ready to determine for what goal it is getting used?” Sitharaman requested.

She gave the instance of the Enforcement Directorate (ED) detecting substantial cash laundering, in all probability circumstances associated to crypto belongings and buying and selling of belongings, lately in India.

Learn Additionally

“This concern has been really acknowledged by a number of members of the G20 saying sure cash path, sure cash laundering, sure drug misuse, and so forth. There may be an understanding that we have to have some type of regulation, and that each one the nations must be true collectively on it, nobody nation goes to have the ability to singularly deal with it. So on that we are going to definitely have one thing,” Sitharaman stated.

In July, Sitharaman stated the Reserve Bank of India (RBI) has expressed considerations over cryptocurrencies, saying that they need to be prohibited as they will have a destabilising impact on the financial and financial stability.

“In view of the considerations expressed by the RBI on the destabilising impact of cryptocurrencies on the financial and financial stability of a rustic, the RBI has beneficial framing of laws on this sector. The RBI is of the view that cryptocurrencies must be prohibited,” she stated in a written reply to the Lok Sabha.

The RBI has talked about that cryptocurrencies usually are not a foreign money as a result of each fashionable foreign money must be issued by the central financial institution or the federal government, she informed Parliament.

FbTwitterLinkedin