The Employees’ Provident Fund (EPF) is a compulsory contribution provident fund that gives the workforce with advantages for insurance coverage, pensions, and financial savings. Each month, 12 % of each common worker’s primary pay (and dearness allowance, as relevant) is contributed to the fund. The contribution is saved within the worker’s EPF account, and at retirement, your complete quantity contributed—together with an identical contribution from the employer and curiosity—will be withdrawn. Nevertheless, utilizing the Employees’ Provident Fund Organisation (EPFO) web site, one can withdraw some early EPF funds on-line.

Vital:

A full withdrawal from an EPF account is simply permitted within the occasion that an individual retires or is unemployed for a interval longer than two months. Nevertheless, the EPFO has made provisions for partial withdrawal in some circumstances, together with illness, marriage, residence renovations, and so forth.

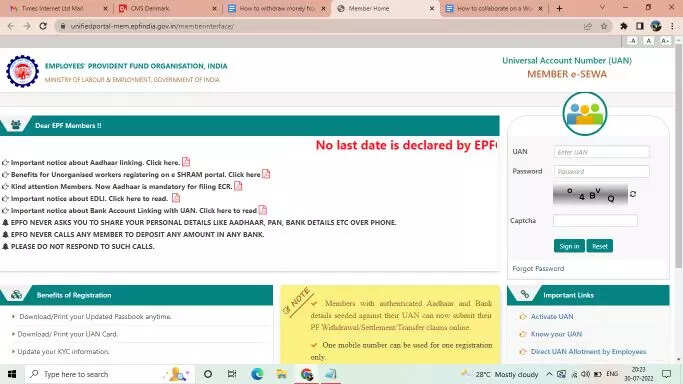

Go to the UAN Member e-Sewa web site. (https://unifiedportal-mem.epfindia.gov.in/memberinterface/)

Sign up to your EPF account by getting into your UAN quantity, password and the CAPTCHA code.

Click on on the “On-line Providers” choice from the highest menu.

Click on on the CLAIM (FORM-31,19,10C&10D) choice.

Confirm the data that seems on the net declare kind and enter your checking account quantity.

Choose the “Sure” button on the certificates of enterprise after choosing the “Confirm” button.

Click on on “Proceed to On-line Declare.”

You have to point out on the declare kind in case you are requesting an advance PF withdrawal. It should show a drop-down menu titled “Goal for which advance is required,” from which you’ll be able to select one of many obtainable functions to satisfy your withdrawal requirement.

Enter the required quantity within the textual content field after which fill out the Worker Deal with part together with your mailing deal with.

Click on on the certificates and submit your request.

FbTwitterLinkedin