China Mobile goals to lift as much as 56 billion yuan ($8.8 billion) in what might be the nation’s greatest public providing in a decade, a yr after being kicked off the New York Stock Exchange.

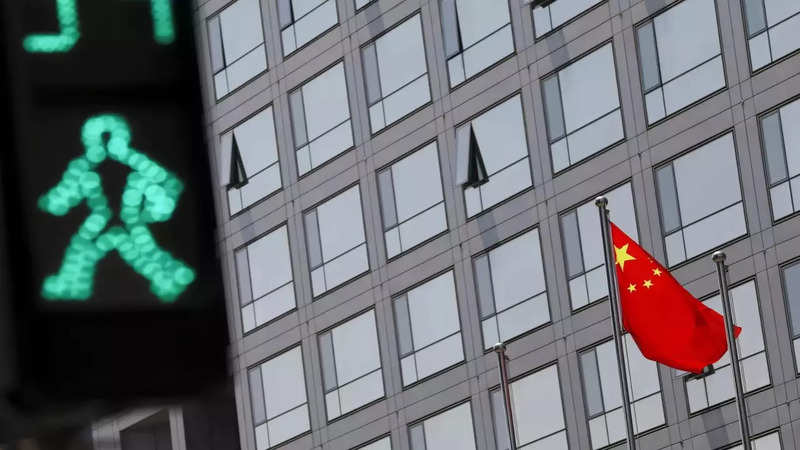

The world’s largest cellular community operator by whole subscribers is promoting shares publicly in Shanghai, as a rising variety of U.S.-traded Chinese companies search listings in China or Hong Kong amid rising Sino-U.S. tensions.

Washington this month blacklisted Chinese language corporations, together with AI firm SenseTime Group, over allegations of human rights violations, and finalised guidelines to kick non-compliant Chinese language companies off American exchanges in three years.

China Cell mentioned in a prospectus that it plans to promote as much as 845 million shares at 57.58 yuan apiece, elevating as a lot as 48.7 billion yuan earlier than an over-allotment possibility is exercised.

After that possibility is totally exercised, it is going to elevate as much as 56 billion yuan, making the general public share sale China’s fifth-biggest on document, in accordance with Refinitiv knowledge. It might even be China’s greatest itemizing since Agricultural Financial institution of China’s public providing in 2010.

China Cell mentioned proceeds from the providing can be used to develop tasks together with premium 5G networks, infrastructure for cloud sources and clever ecosystems.

China Cell’s smaller state-owned rivals, China Telecom and China Unicom, are already listed in China.

The three have been delisted from the New York inventory change after a Trump-era choice to limit funding in Chinese language expertise companies, which has been left unchanged by the Biden administration amid persevering with tensions between Washington and Beijing.

Along with the sanctions, the U.S. Securities Alternate Fee (SEC) this month finalised guidelines to delist U.S.-listed Chinese language corporations below the Holding Overseas Corporations Accountable Act (HFCAA).

In accordance with accounting agency EY, 5 of the highest 10 Hong Kong listings in 2021 have been secondary listings of U.S-listed Chinese language corporations, together with Baidu and Bilibili Inc , and the development of Chinese language corporations coming dwelling will proceed.

FbTwitterLinkedin