JPMorgan is difficult British rivals on their dwelling turf with the launch on Tuesday of its long-awaited digital retail bank, Chase, as a part of what the U.S. lender hopes shall be a worldwide enlargement.

The launch marks the primary foray into retail banking exterior North America by one of many United States’ most dominant lenders, heaping stress on British incumbents reminiscent of Lloyds , Barclays, NatWest and HSBC that are already battling low rates of interest and upstart digital rivals.

“Now we have been watching through which markets prospects are actually able to do their banking primarily via digital channels, and the UK frankly leads the best way on this respect” mentioned Sanoke Viswanathan, chief government of the brand new Chase financial institution enterprise.

The enterprise, if profitable, may see the U.S. financial institution develop into continental Europe after which globally, he mentioned.

“It is a enterprise that we’re constructing not only for the UK however hopefully for the remainder of the world, and there’s a nice confluence of expertise right here throughout the completely different product features, so it is an important place to construct a worldwide headquarters for this new enterprise,” he mentioned.

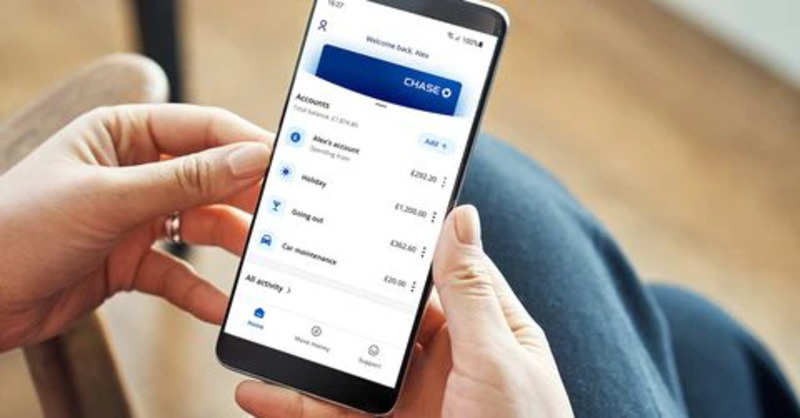

JPMorgan will tempt prospects to enroll in the fee-free accounts with introductory provides, together with 1% cashback on debit card spending and 5% curiosity on small change rounded up from their purchases and put aside in a separate financial savings pot.

“With a powerful expertise platform, important monetary sources and a worldwide model title, JPMorgan might be a critical participant within the UK retail banking area,” Nic Ziegelasch, Analyst at dealer Killik & Co mentioned.

The Wall Road big enters a aggressive British market with razor-thin margins brought on by low central financial institution rates of interest and a practice of free present accounts, versus most world markets the place prospects pay for even fundamental providers.

“The market construction within the UK is such that you need to generate economies of scale, there are earnings to be made however in case you are subscale or have a excessive price infrastructure you are not going to make it work,” Viswanathan mentioned.

JPMorgan is following U.S. rival Goldman Sachs, which scooped up billions of kilos in deposits when it launched its Marcus digital financial institution in Britain in 2018 with a then-market-beating rate of interest of 1.5% on financial savings.

It would additionally compete with digital-only banks reminiscent of Monzo, which has attracted round 5 million prospects with its signature coral pink playing cards and user-friendly app, however struggled to show that into regular earnings.

The financial institution has already employed some 500 workers in Britain, Viswanathan mentioned, and can add extra because it builds up its buyer assist groups.

FbTwitterLinkedin